For all its faults, 2020 has prompted a homecoming to our values. As we deepen our understanding of impact investments, heart-fully face systemic racism, and wrestle with the wealth divide, we are also bearing witness to our clients going through the same process. During this year, advisors and clients alike are asking themselves this critical question:

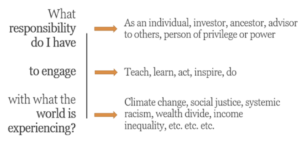

What responsibility do I have to engage with what the world is experiencing?

Within this question, there are several sub-questions:

- What level of responsibility are we embracing when we ask ourselves this question?

- What level of engagement are we willing and able to lean into?

- Which issue(s) are we equipped (mentally, emotionally, and logistically) to engage with?

What do you consider your highest level of responsibility? Having a personal framework can help you identify the degree of change or engagement you are ready for in this season of your personal and professional life.

"It's difficult to get a man to understand something when his salary depends upon his not understanding it." – Upton Sinclair

Facing the social and environmental issues mentioned at the open can be an outright challenge to what we do for a living, or at the very least, how we've been doing it. Leaning into these issues compels us to look at the world and our place in it from new viewpoints and to consider how we may be willing or need to change.

Question the rules

For decades, advisors have lived by two rules in working with our client families:

"Take the emotion out of investing."

Historically, this has translated beyond the cognitive work we do as MQ partners. It's supposed to mean, "Don't let your emotions influence your participation in the market." In many cases, it has also translated to, "Don't use your emotions to direct your investment or spending decisions."

Where and how clients are directing their resources is part of their everyday conversation. They're deciding whether to buy their Christmas gifts from the local mom and pop or Amazon; whether to order their groceries curbside from the local market or Walmart. They're choosing to order takeout to keep their favorite restaurant afloat rather than hitting the drive-thru.

If our clients are making these decisions with their spending, isn’t it up to us to help them uncover the other ways they can use their dollars to uphold their values? Isn’t it our job to learn, grow, and expand our knowledge-base on investment choices that can support those values?

“Don’t get political.”

This rule has been around for decades, but the political environment of today hasn't. In 2020, does this still resonate? Can we still abide by this rule when social justice movements have policy impacts and ESG investments carry a political spin?

When questioning these rules, ask yourself: is it possible, helpful, or wise to remain neutral as an advisor, or is that, in and of itself, perpetuating historical racial inequities and barriers between what our clients care about and how they direct their resources?

Actively seek diverse perspectives

The percentage of diverse voices in the financial planning industry is still dismal. Only 23% of CFP's are women, a statistic that's a percentage point lower than it was two decades ago. Less than 4% of CFP's are black or Latinx, while that population makes up nearly 30% of US Citizens. There is a severe dearth of these critical, influential voices in industry conversations.

Given these statistics, it's probably fair to assume that if you're an advisor reading this, you're white or white-passing. If change is heavy on your heart and mind, but you don't know where to start, you are not alone. Suppose you can get to a place where you recognize the generations of privilege you were born into, how that privilege has positioned you for the success you enjoy today, and how your life would look very different without it. In that case, you're standing at the entrance of lifelong antiracism work. Once you start down this path, it will impact how you live your life and how you practice financial planning.

Facing the social and environmental issues of today can be an outright challenge to what financial advisors do for a living, or at the very least, how we've been doing it. Click To TweetThose of us who are white or white-passing cannot put our responsibility to do this work on the BIPOC community. We must do the work. We must share what we learn with each other. We must expect to make mistakes as we go and sincerely welcome corrections to those mistakes. We must seek opportunities to bring what we’ve learned into the conversations that matter. We must stand with diverse voices to become an inclusive industry. We must let go of our deeply rooted (and learned) desire to be the expert - the advisor. We are not the experts here.

Continue to identify and embrace your role

What role are you able to embrace in this social change ecosystem? (Please refer to the image and click to enlarge). Are you a weaver who sees through-lines of connectivity between people, places, organizations, and movements? Or are you a builder who develops, organizes, and implements ideas, practices, people, and resources? As an advisor, you might identify as a guide. You teach, counsel, and advise. You use your gifts of well-earned discernment and wisdom in service of the collective vision.

Let us keep learning from those who know more than we do. Let’s keep the conversation going with one another. Let’s stay vulnerable and compassionate. Let’s elevate our profession.

Other resources to explore

- Race in Finance Series | Robasciotti & Philipson

- What I’ve Learned from Talking with White Advisors | Morningstar

- Mapping Our Roles in a Social Change Ecosystem | Deepa Iyra

- 2050 Trailblazers (Podcast) | Rianka R. Dorsainvil

- Brenna Baucum, CFP®