Advice is inherent to financial planning. Heck, it’s in your title: advisor. But how you give advice can make or break the client/advisor relationship and directly impact the follow-through.

The Righting Reflex

The righting reflex is our natural reaction to hearing someone else’s problem. This is the powerful urge to provide our own opinions, solutions, and anecdotes in response to an issue, often before we hear the whole story. We try to shape their perspective and show them the ‘right’ path with the limited amount of information we have. This is human nature; it’s how we’re wired.

The righting reflex is our natural reaction to hearing someone else’s problem. This is the powerful urge to provide our own opinions, solutions, and anecdotes in response to an issue, often before we hear the whole story. We try to shape their perspective and show them the ‘right’ path with the limited amount of information we have. This is human nature; it’s how we’re wired.

Advisors have another layer added to this reflex. You spent several years acquiring credentials and experience to do what you do. Over countless hours of studying, you learned that there is ‘an’ answer for every question. This implies we are the ones to provide solutions. The righting reflex is especially strong in a field like ours. It takes conscious effort to tame it.

The righting reflex is especially strong in a field like ours. It takes conscious effort to tame it. Click To TweetPsychological Reactance

Just as the righting reflex is innate, so too is psychological reactance. This is our (and our clients') normal reaction to persuasion. We resist or do the opposite of the advice we’re given, even if we agree and understand the logic behind it. When we receive persuasive advice, we feel disrespected, defensive and withdrawn; not feelings we want our clients to have in their work with us. This feeling of disconnect goes both ways:

“It’s not only the other person that is diminished in this moment when your advice monster is in control. You’re diminished as well. Because when your advice monster is in control, you lose that connection to your humanity. You lose that connection to your empathy and your compassion and your sense of vulnerability. You start using your answers as your armor.”

- Michael Bungay Stainer,

How to Tame Your Advice Monster

Prematurely providing solutions can inhibit your client’s ability to clarify or resolve the issue themselves. If the issue is cash flow, for example, one person gets to choose whether to implement a spending plan. Your client has to be the one to discover the motivation to change. No amount of data will spark meaningful action until they are ready to receive it.

Skillful Advice Giving

It’s not uncommon for advisors who love this work to refer to financial planning as a “helping profession.” This describes what’s at the heart of their motivation and purpose. There is a way to channel your helping nature into skillful advice-giving, which yields a very different result than the righting reflex.

Step 1: Elicit - before giving information, ask your client what they want to know.

This seems obvious, but we often show up to a meeting with an agenda that we created without the client’s input. If you’re meeting with a client you haven’t seen in a while, make sure you focus your precious time on the topics that are top of mind for them. It might not be the trailing 12-month performance. Invite the client to tell you what you can cover together to make your meeting valuable. Then listen intentionally and keep your focus there.

Once a client tells you their main interest or concern, you can elicit further input by asking, “What do you already know about this?” or “Are there any ideas you already have about this?”

Step 2: Provide a few bits of information to answer their question and a few options.

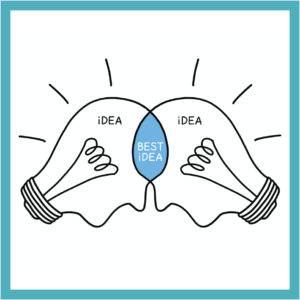

This is not the time to dive deeply into every possible option. That would overwhelm them. On the other hand, if we choose just one option, we inhibit our client’s autonomy and invite psychological reactance. Providing some preliminary information and two or three options opens the door to co-creating a solution.

Be thoughtful about the way you phrase these options. “We might consider trying…” invites the client to give their thoughts on these options and puts you on the same side of the table. Alternatively, a statement like, “You should try…” implies a directive approach that’s likely to be received negatively and separates the collaborative relationship you want to foster.

Step 3: Elicit again - invite their thoughts and input on what you just said.

Good follow-up questions might be, “What are your thoughts about these options?” or, “Knowing what you know about yourself and the work we’ve done together, which of these might fit into your life the best?” When you ask for their feedback, you learn which options they’re attracted to or resistant to and the reasons why.

As an advisor, you have the unique opportunity to increase your client’s self-efficacy—their level of confidence in their ability to complete a task or achieve a goal. Taming your righting reflex and utilizing skillful advice-giving techniques can create an autonomous supportive environment for your clients that will encourage collaboration and foster internal motivation for positive change.

- Brenna Baucum, CFP®