In his article “Why Good Financial Behavior Isn’t Achievable Until You Believe That It Is,” Derek Tharp addresses the frustration that financial planners experience when trying to help clients adopt healthier financial habits. He explains the root cause of self-sabotaging money beliefs and behaviors in this way:

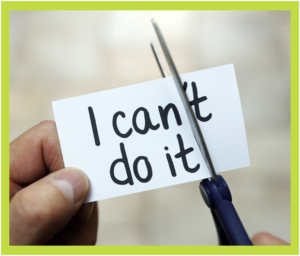

As almost all financial advisors have experienced, instilling behavior change in clients can be a tough task. Though we can easily see ways in which clients could improve their behavior for the better (which are often known by clients as well), the reality is that merely telling clients about how they can improve their behavior is rarely enough to actually get them to do so. While there are many reasons why this could be the case, one common barrier to behavior change is that if the client isn't self-confident in their own ability to successfully make the change in the first place – lacking the "self-efficacy" to be successful – then the change simply doesn't happen.

Derek Tharp, Ph.D., CFP, Clu, RICP

kitces.com

As a remedy, Tharp encourages planners to get acquainted with the concept of financial self-efficacy and its implications for promoting financial success and well-being. Without a doubt, financial planners who wish to help their clients implement better financial behaviors should not ignore the potential power of promoting financial self-efficacy.

… financial planners who wish to help their clients implement better financial behaviors should not ignore the potential power of promoting financial self-efficacy.. Click To TweetWhen it comes to helping clients make good decisions, helping clients believe they can accomplish the financial behavior in the first place is crucial!

Background

The term “self-efficacy” was first introduced by world renowned psychologist Albert Bandura who defined this characteristic as an individual’s belief in their own ability to succeed in accomplishing a specific goal or task.

In fact, he found that people with a strong sense of their capabilities also share these characteristics:

-

- View difficult tasks as challenges to be mastered

- Develop a deep interest in their activities

- Set challenging goals and maintain a strong commitment to reaching them

- Recover quickly from setbacks and disappointments

In contrast, individuals with a weak sense of of their capabilities share these characteristics:

-

- View difficult tasks as threats to be avoided

- Quickly lose confidence and dwell on personal deficiencies and other obstacles to achieving desired results

- Have low aspirations and weak commitment to goals

- Are slow to recover from setbacks and disappointments

Practical Application

It is important to understand that financial self-efficacy is not only related to one’s level of financial knowledge and skills. As Tharp explained, an individual could possess high levels of financial skills and knowledge, and still lack the self-confidence needed to engage in behaviors that capitalize on this knowledge. In addition, a number of studies have demonstrated that several subjective factors—such as personality, family history, social and cultural norms, and frames of reference—also shape an individual’s level of financial self-efficacy.

Therefore, because self-efficacy is task specific, it is important to consider how Bandura’s four strategies for increasing self-efficacy can be applied specifically to personal finance:

1. Experiencing Success

The most effective way to build a strong sense of self-efficacy is through performing a task successfully. Therefore, successfully completing one important financial task will increase confidence in their ability to tackle the next one!

2. Choosing Role Models

Witnessing friends and family members mastering a money management task is another important source of financial self-efficacy. According to Bandura, “Through their behavior and expressed ways of thinking, competent models transmit knowledge and teach observers effective skills and strategies for managing environmental demands."

3. Responding to Encouragement

Bandura also made the assertion that people can be persuaded to believe that they have the skills and capabilities to succeed. Therefore, hearing and accepting encouragement from you, their trusted financial advisor, will help your clients to overcome self-doubt. By helping them to focus on their financial accomplishments, versus their mistakes, will increase their self-esteem.

4. Managing Emotional Responses

Moods, emotional states, physical reactions, and stress levels can all impact how individuals feel about their personal abilities in a particular situation. However, by learning how to minimize stress and elevate mood when facing difficult or challenging financial tasks, your clients can greatly improve their sense of self-efficacy in this area of life.

Conclusion

Evolving from research related to positive psychology, self-efficacy has been found to be an important attribute related to self-confidence and positive change in all areas of life. In addition, there is a growing body of research that suggests that financial advisors can help their clients build higher levels of confidence in their ability to engage in healthier and more productive financial behaviors.

Though it’s not a term many of us are likely familiar with, financial self-efficacy is an important concept for financial planners to understand and help promote in clients. Our clients’ confidence in their ability to carry out a financial behavior is ultimately a key driver of successfully implementing a financial plan.

Derek Tharp, Ph.D., CFP, CLU, RICP

kitces.com