In this recent episode of the Standard Deviations podcast, Dr. Daniel Crosby explores the concepts of Financial Wellness vs Financial independence. The guest, Dr. Thomas Mathar, shares his insights into these two important aspects of personal finance and how they intersect with overall well-being. Dr. Mathar emphasizes that financial wellness goes beyond mere financial stability […]

Trending Links

The Iceberg Follow-Up Model

In an article titled, “Fact, Situation, Feeling – Using The Iceberg Follow-Up Model To Connect With And Motivate Clients”, Meghann Lurtz, PH.D., FBS, introduces a 3-part approach that helps to uncover what’s most important to the client while also developing and deepening the client-advisor relationship. The stages of the model include: Fact-finding Situational exploration Emotional […]

Invest Like A Psychopath

In a recent episode of the 50 Fires podcast, Carl Richards spoke with Jamie, a diagnosed psychopath. This very incisive episode, Invest Like a Psychopath, explores psychopathy and money. How do neuro-diverse individuals think about their money and their life? How might they make financial decisions differently than neuro-typical individuals? I will not put myself […]

Helping Clients Find Deeper Meaning for their Money

This eMoney article explores the components of meaning, shallow vs deep meaning, and the connection between money and meaning. Derek Hagen, CFP suggests that the meaning in life is comprised of 3 parts: Purpose: Do clients have something to look forward to? Significance: Do clients feel like they matter, are valued, and that life is worth […]

The Future of Everything is Human First

Dr. Daniel Crosby did a special solo episode of the Standard Deviations Podcast for an episode on the shift of problems due to economic development, France’s public urination problem, and why Human-First is the antidote to the technological standardization we are already seeing affect the industry. “You are hired, retained, and help your clients most, […]

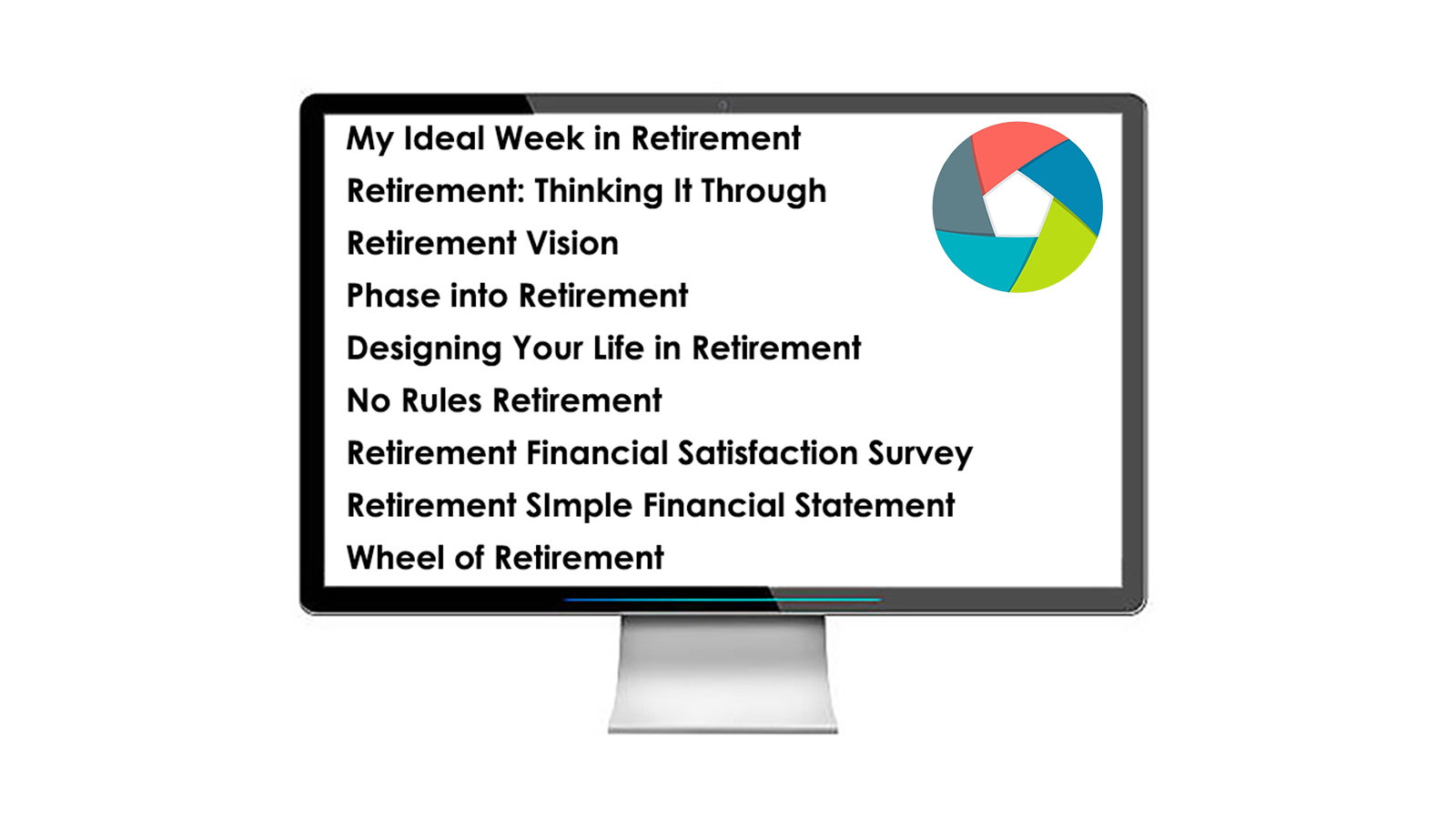

Why is Retirement so Stressful?

Why is retirement so stressful? According to the Harvard School of Public Health, the risk of a stroke or heart attack is 40% higher during the first year of retirement. Retirement is a goal, process, and mindset. With all of the changes going on, adjusting to a new life isn’t always straightforward. “Unless you ‘practice […]

Personality and the Most Hated F-Word!

In a recent episode of The Most Hated F Word podcast, Shaun Masylk spoke with Dr. Sarah Fallaw about The Scientific Research Behind Money-Related Personality of Self-Made Millionaires. How does personality impact financial decision-making? How do people move from income to wealth? Can you elicit similar behavior change from varied personalities? “One of the components […]

Why People Hire … and Fire … Their Financial Advisors

Brendan Frazier hosted Samantha Lamas and Danielle Labotka on The Human Side of Money Balance Podcast for an episode on some research that attempts to understand, “Why Clients Actually Hire & Fire Their Financial Advisors.” “If it’s not delivered in a way that shows that you understand how I’m feeling or why I want this […]

The Art of Story-Listening

Dr. Preston Cherry joined the Real Money, Real Experts podcast for an episode on The Art of Storytelling and Story Listening. They chat about how he uses storytelling with his clients, how to actually go about creating stories, and how to balance empathy and vulnerability. “When somebody says ‘Oh Yes!’, and then they start talking, it’s […]

What is your Niche?

A fascinating report on Financial Advisor Marketing Effectiveness showed that niche firm marketing effectiveness is much higher than generalized firms. While the industry saw less than 25% of marketing strategies prove effective, niche firms, “had greater satisfaction with the number of leads received, the ‘fit’ of the prospects with the firm, and the effectiveness of […]