True Wealth Process and Stages

Our research-based MQ True Wealth™ Process creates a foundation for meaningful dialogue and provides a robust model for delivering personalized financial advice that strengthens client relationships and differentiates you in the market place.

There are five stages to this process: Explore, Engage, Envision, Enlighten, and Empower. Each stage is designed to facilitate an effective communication cycle and support successful client engagements.

Explore Stage

Develop and strengthen trust by establishing and demonstrating the importance of understanding your clients’ values and priorities.

Engage Stage

Facilitate a discovery process that will engage your clients’ hearts and minds while also providing important insights regarding each person’s unique frame of reference.

Envision Stage

Assist your clients in developing a vision of the future that will inspire enthusiasm and lay the foundation for meaningful life and financial goals.

Enlighten Stage

Present your financial plan and advice in a way that communicates an understanding of your clients’ concerns, interests, and aspirations while effectively linking financial strategies to their life goals.

Empower Stage

Utilize proven strategies for keeping your clients engaged, motivated, and on the path to achieving their financial goals.

The MQ True Wealth Process is an example of a Virtuous Cycle:

1. A process or practice that is strengthened by its results.

2. A loop of actions or events whereby results allow the loop to be repeated with ever increasing results. It is associated with self-reinforcing practices and processes that gain strength from their outputs.

simplicable.com

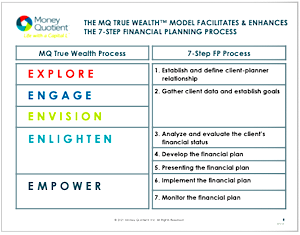

Alignment with 7-Step FP Process

In addition, the MQ True Wealth Process can be viewed in a linear format to show how each stage facilitates and enhances the 7-step financial planning process as defined by the Certified Financial Planner Board of Standards, Inc.

The Standards of Professional Conduct define financial planning as “the process of determining whether and how an individual can meet life goals through the proper management of financial resources. Financial planning integrates the financial planning process with the financial planning subject areas.” There are 7 steps to the financial planning process:

- Establishing and defining the client-planner relationship

- Gathering client data including goals

- Analyzing and evaluating the client’s current financial status

- Developing recommendations and/or alternatives

- Presenting recommendations and/or alternatives

- Implementing the recommendations

- Monitoring the recommendations

Certified Financial Planner Board of Standards, Inc.

Tools & Materials

MQ True Wealth client meeting tools and educational materials will elevate your value proposition and differentiate you in the marketplace. These resources are evidence-based and will provide you with the foundation for a truly life-centered practice that is characterized by meaningful client communications and successful, long-term relationships.

In addition, the breadth of the MQ suite of discovery tools will facilitate your understanding of each client’s relationship with money as well as the set of values, attitudes, and beliefs that shape their unique frames of reference. This knowledge and insight will indicate how to tailor your financial advice to each client’s needs, expectations, and aspirations.

To this end, the MQ True Wealth tools and process will guide and structure your qualitative inquiry in four key areas: Satisfaction and Values, Biography, Transitions, and Goals.

Satisfaction and Values

The first step to making positive change in any area of life is awareness. Therefore, the MQ client materials in the Satisfaction and Values category enable planners to help their clients think about and assess their own levels of financial and life satisfaction while also identifying and clarifying their values. Understanding your clients' values and helping them to assess their satisfaction in various facets of life is crucial in developing successful financial plans

Biography

MQ client materials in the Biography category help you to gather information about your clients' past and present lives that will give you clues concerning the experiences that consciously and/or subconsciously influence their current financial beliefs and behaviors. Important biographical data include family and work histories, current family circumstances and responsibilities, current life transitions, and likely future life transitions. Additionally, biographical questions will expand your understanding of your clients' fears, concerns, values, priorities, plans, and dreams.

Transitions

Because nearly all of life’s transitions have a financial tether, it is important to understand that making successful transitions requires both practical strategies and emotional fortitude. From a practical standpoint, financial resilience requires a foundation of basic financial knowledge and a strategy for building financial security. From an emotional standpoint, financial resilience requires self-confidence. MQ client materials in the Transitions category will help your clients to reflect on how they have dealt with transitions in the past, assist them in managing current transitions, and aid them in planning for transitions they are anticipating in the future.

Goals

Setting goals is a method of anticipating, planning, and preparing for the future. However, until your clients are able to specify what they want and why they want it, the goals they set will be ineffective in motivating positive change. If you, as a True Weath Planner, facilitate a meaningful goal-setting process, your clients will be intrinsically motivated to pursue the life and financial goals that they establish. The MQ materials in the Goals category are designed to help your clients adopt a fresh perspective on goal-setting and to align their visions of the future with their personal values and priorities.