Mary Bell Carlson, AFC®, CFP®, Ph.D. and Rachel DeLeon interview Dr. Erika Rasure in podcast “Real Money, Real Experts”. In this episode, they discuss the biases that exist within the industry; how money stories and very human decisions are too often surrounded by embarrassment or shame; and the importance of helping people move through financial […]

Trending Links

Financial Lenses & Challenging Perspectives

Mary Martin, Ph.D. and Julie Fortin, CFP®, FBS, CeFT write about reimagining lenses and ask some incisive questions about how we operate as financial service professionals. Is asking about ROI when thinking about well-being the right question to ask? Should humans be serving the economy or should the economy serve humans? Do firm metrics demonstrate […]

Amy Mullen Speaks with Dr. Daniel Crosby

Dr. Daniel Crosby invited Amy to join the Standard Deviations Podcast for an episode on values-based financial planning, creating a practical process within your practice, and engaging motivation within clients. “The psychologist in me is screaming, ‘Look, people don’t have great insights into their own behavior and values and impluses generally’ and, I would say, […]

Meghaan Lurtz on the Impact of Questions to Relationships

Meghaan Lurtz spoke at The Exit Planning Summit and talked about the impact that questions can have on the client relationships. “We can ‘command an answer’ over ‘asking a question’. It gets us to the same place, but doesn’t set the alarms off in the brain, keeps people calmer…more open.”

Jane Mepham, CFP® on Investing for Nonimmigrant Visa Holders

Foreign-born workers with work visas face a unique set of financial challenges that most native-born U.S. citizens never need to consider. Retirement plans, Health Savings Accounts, child education, and many more issues are significantly more complicated due to complex regulations and laws, both in the United States and in their home countries. MQ Partner (and […]

Amy’s “On The Circuit” Podcast Interview

While visiting San Antonio during May’s Shift Conference, MQ President Amy Mullen, CFP® chatted with Johnny Sandquist and Brodrick Lothringer for a 30 minute podcast. In this episode of On the Circuit: Amy Mullen, CFP® and President of Money Quotient, Inc., discusses how advisors can lean into behavioral science to foster trust and grow their […]

Chaos and Order: Keys to Effective Financial Planning

In “How the Chaos/Order Cycle Relates to Financial Planning,” MQ Partner Joseph Kuo, CFP writes about the parallels that can be found in “creation myths” and financial planning. But as with the chaos cycle in mythology, financial planning follows a similar cycle. As time passes, we progress, and our lives change, the plan no longer […]

Podcast: The Elements of a Financial Intimate Coupleship

In a recent edition of The Financial Therapy Podcast, MQ Partner Rick Kahler discusses his new book with his co-author, Debra Kaplan. Rick talks with his guest, Debra Kaplan, about their collaboration that resulted in them writing Coupleship Inc: From Financial Conflict to Financial Intimacy. They dive into some of the elements of a financially […]

Amy Mullen, CFP® Explains How to Influence Client Relationships With One Simple Inquiry

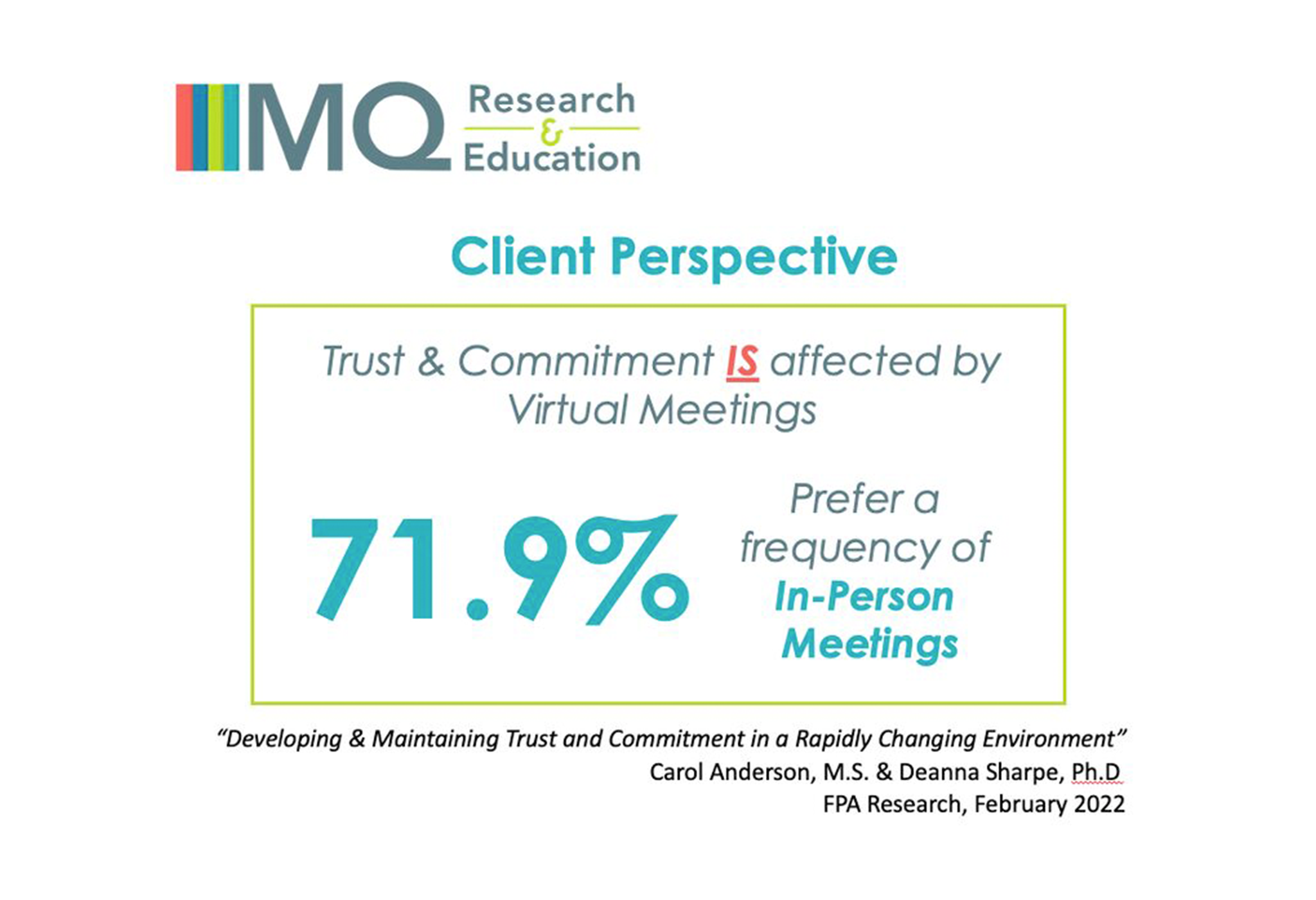

Virtual meetings can help to increase convenience and availability; however, the format of such meetings can have a drastic effect on a client’s trust and commitment to their financial advisor. MQ President Amy Mullen, CFP® shares additional information regarding recent MQ Research & Education research, explaining how advisors can influence the success of their client […]

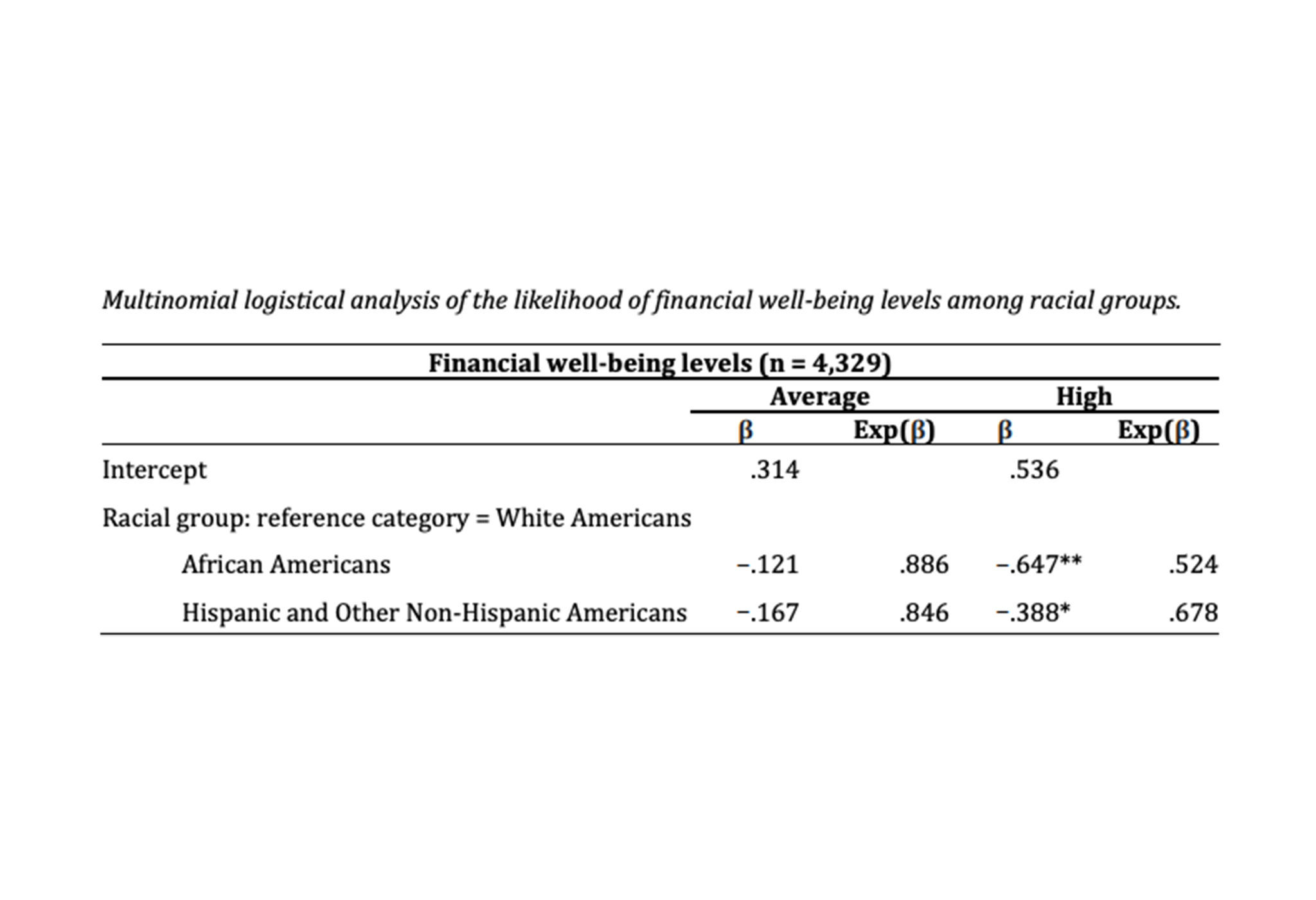

Psychological Factors that Affect African American’s Financial Well-Being

Unfortunately, the financial security and well-being to navigate the unexpected and fulfill long-term goals is not an equally-shared experience for all families. An article published by the Journey of Financial Therapy explains the psychological factors that can result in African Americans’ positive relationships with their financial well-being.